By: John Hsieh

Published: Sep 17th, 2025

Health insurance is one of the top expenses for any business, yet most employers don’t realize how much their funding model affects cost, risk, and control. This guide breaks down fully insured, self-funded, level-funded, and cost-sharing options, showing how each works and when they may fit. Employers who understand these models gain clarity and a path to sustainable healthcare costs.

Health insurance is one of the largest expenses for most businesses, often ranking just behind payroll. Despite the cost, many employers treat it like a line item they can’t influence because the system feels complicated and opaque. That’s a mistake. The way your plan is funded directly affects what you spend, how much risk you take on, and how much control you have over your benefits.

At SALTA, we believe employers deserve clarity. There are three main funding models to choose from: fully insured, level funded, and self-insured. Each works differently, and each comes with its own tradeoffs. In this article, we’ll break them down and help you see which one might be the best fit for your business.

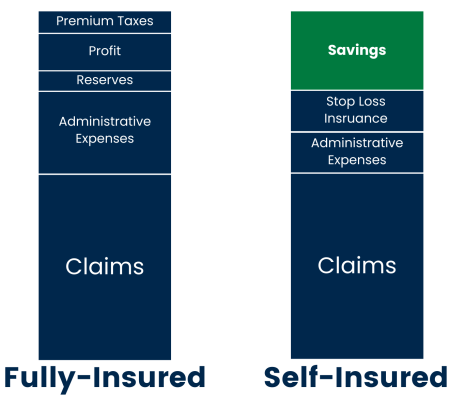

The fully insured model is the one most employers know. It works much like car insurance. Employers pay a fixed premium each month, and the insurance company takes responsibility for paying employee medical claims. If claims exceed the premiums collected, the carrier covers the difference. If claims are lower, the carrier keeps the margin.

Premiums are recalculated each year based on how much was spent on medical claims. When claims rise, carriers raise premiums in the following year to cover those higher costs with the employer’s money rather than risking their own. In other words, high claims are never absorbed permanently by the insurance company. They come back as higher rates at renewal.

This is why cost-conscious healthcare decisions matter. If an employee chooses a $3,000 MRI when a $400 option is available, the extra cost flows directly into the claims pool. Employers can help by educating their teams about how spending affects future premiums and by creating ways to guide employees toward smarter choices. Offering Direct Primary Care is one approach that reduces claims by handling routine care outside of the insurance system.

Transparency is another challenge. Employers typically see the total claims cost each year but not the details of how money was spent. That lack of visibility makes it difficult to know whether the plan is being managed responsibly. Fully insured plans have generally been viewed as meeting fiduciary standards under ERISA, but recent lawsuits suggest this may no longer be the case. Carriers are being challenged over whether their practices, such as pharmacy benefit management, are consistent with acting as good stewards of plan dollars.

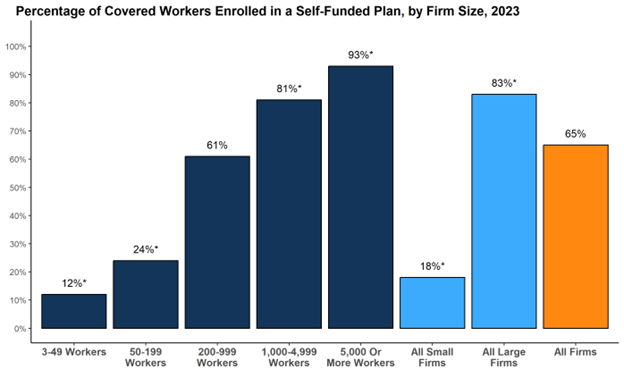

Self-funding is where the employer takes on the role of the insurer. Premiums no longer flow to a carrier that carries the risk. Instead, employers and employees contribute to a pool of money, and medical claims are paid directly from it. If claims are high, the employer pays more. If claims are low, the employer keeps the savings.

Every self-funded plan is built on three pillars: stop loss insurance, a Pharmacy Benefit Manager (PBM), and a Third Party Administrator (TPA).

Stop Loss Insurance

Stop loss is the safety net. It sets a ceiling on how much the employer will ever pay in a given year. If claims exceed that ceiling, the stop loss carrier covers the rest. The tradeoff is that large claims in one year drive stop loss costs higher in the next, while favorable performance creates leverage to negotiate rates down. This protection is what makes self-funding possible.

Pharmacy Benefit Manager (PBM)

The Pharmacy Benefit Manager, or PBM, manages prescription drugs for the plan. A PBM negotiates prices with pharmaceutical companies and pharmacies by pooling the purchasing power of many employers. Without this partnership, employees would face much higher drug costs. Pharmacy spending is one of the fastest-growing parts of any health plan, which makes this role essential. There are also ways PBMs can take advantage of employers, such as hidden fees or not passing rebates back. Those topics will be covered another time. For now, it is important to understand that a PBM is necessary for employees to receive affordable drugs.

Third Party Administrator (TPA)

Although the employer funds the claims, it does not pay healthcare providers directly. Those administrative responsibilities are handled by a Third Party Administrator, or TPA. The TPA processes claims, manages networks, and provides reporting. Sometimes large carriers act as TPAs, which is why employees may still carry a Blue Cross or Cigna card even though the employer is funding the plan. More recently, independent TPAs have grown in popularity because they offer far greater transparency. Choosing the right TPA matters because it determines whether an employer receives detailed claims-level data or only high-level summaries.

Unlocking Control Through Data

The ability to see real claims data is often the most valuable part of self-funding. For the first time, employers can see exactly where their money is going and respond with targeted strategies. If pharmacy costs are high, the solution may be ensuring employees stay on the formulary. If imaging costs are inflated, employees can be guided to lower-cost centers. If surgeries are driving claims, bundled cash-pay procedures may provide better value. Employers can also use incentives, such as waiving deductibles for a $400 MRI while requiring cost sharing for a $3,000 scan.

Self-funding unlocks enormous potential, but it must be actively managed. Without education and guidance, it can quickly become a recipe for higher costs. Direct Primary Care often serves as the quarterback of the plan. Since most care flows through the primary care doctor, such as prescriptions, referrals, and routine services, DPC becomes the hub that helps steer employees toward better and more cost-conscious options.

Here is a quick cheat sheet on the main differences:

Level-funded plans are marketed as a middle ground between fully insured and self-funded. Employers pay one fixed monthly amount, but that payment is divided into three parts: a claims fund for day-to-day medical costs, administrative fees, and stop loss insurance for catastrophic claims.

If claims are lower than expected, the employer may get a refund from the claims fund, though carriers often keep part of the savings. If claims are higher, stop loss insurance covers the excess. Renewals are still based on claims performance, so costs rise when the plan runs poorly.

The bigger limitation is control. Employers usually see only high-level reporting and cannot implement steerage or alternative care strategies because the carrier owns the TPA. That means employees must use the carrier’s network, often at higher contracted rates.

Carriers’ position level funded plans as a safe bridge to self-funding, but they mostly serve to keep employers tied to the carrier ecosystem. The upside is limited, transparency is shallow, and employers gain little of the true control that comes with full self-funding.

Cost-sharing platforms are not traditional insurance. Instead of transferring risk to a carrier, members contribute a monthly amount into a large community pool that can include hundreds of employers and millions of individuals. When someone has a major medical need, that cost is shared across the entire membership. Employers can cover part of the contribution for their teams, and employees typically have an “initial unshareable amount,” similar to a deductible, before sharing begins.

There are different versions of cost sharing. Some operate simply as expense-sharing co-ops. Others, like Sedera, pair the model with Direct Primary Care and steerage tools that guide employees toward cost-conscious options. In those designs, routine care runs through DPC, and employees are rewarded for choosing high-value care. A $400 MRI at a local imaging center may be fully covered, while the same scan at a hospital for $3,000 could leave the employee with significant out-of-pocket costs. Surgeries, labs, and prescriptions can also be steered to transparent or bundled cash-pay providers.

For smaller employers, cost sharing can mean lower monthly costs than fully insured coverage and a structure that encourages smarter healthcare decisions. The tradeoff is that cost sharing is not regulated like insurance, which means fewer protections if rules change or if a claim is denied. It also works best for smaller, healthier groups, rather than large employers with higher-risk populations.

As fully insured plans become harder to afford, cost-sharing is emerging as a real alternative for small businesses. The models that integrate with DPC are especially compelling because they combine lower contributions with built-in mechanisms that keep claims down.

There’s no one-size-fits-all answer. The right funding model depends on your size, your cash flow, and your willingness to get involved in managing costs. Size is the clearest starting point:

Size is only part of the decision. Other factors are just as important:

This framework can help you see where your company fits and what options are most realistic, but it doesn’t replace a deeper review. At SALTA, we help employers move from uncertainty to clarity. If you’re unsure which model is right for your business, we’ll walk through your size, your cash flow, and your goals to design a strategy that truly fits.

Health benefits are one of the largest expenses a business will face, but they don’t have to be a black box. Whether you are fully insured, exploring cost sharing, considering level funding, or ready for self-funding, the key is understanding how each model works and what it means for your company. Employers who take the time to evaluate their options gain more control, more transparency, and a better path to sustainable costs. At SALTA, we believe every employer deserves that clarity and we’re here to help you achieve it.

With DPC now officially compatible with HSAs, there’s never been a better time to take control of your healthcare.

Join SALTA today or schedule a free consultation to see how Direct Primary Care can work for you.

John Hsieh is the Director of Growth at SALTA Direct Primary Care and the Michigan Chapter Lead for the Free Market Medical Association (FMMA). He is passionate about transforming healthcare through patient-centered models like DPC and works closely with employers, brokers, and clinicians to drive cost-effective, high-quality care.